sales tax on food in memphis tn

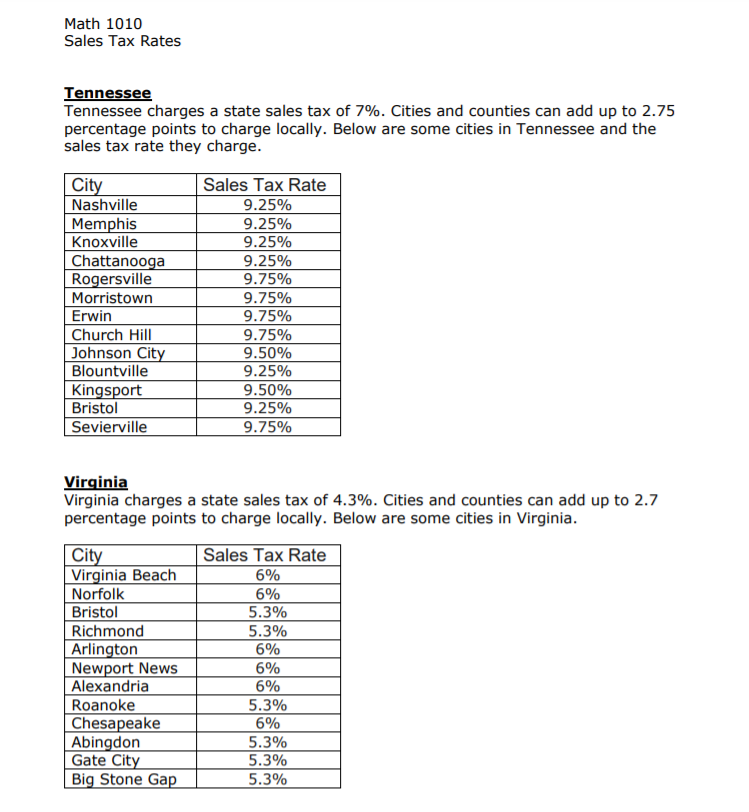

The 975 sales tax rate in memphis consists of 7 tennessee state sales tax 225 shelby county sales. The minimum combined 2022 sales tax rate for memphis tennessee is.

Memphis Tn Cost Of Living Information 2022 Guide

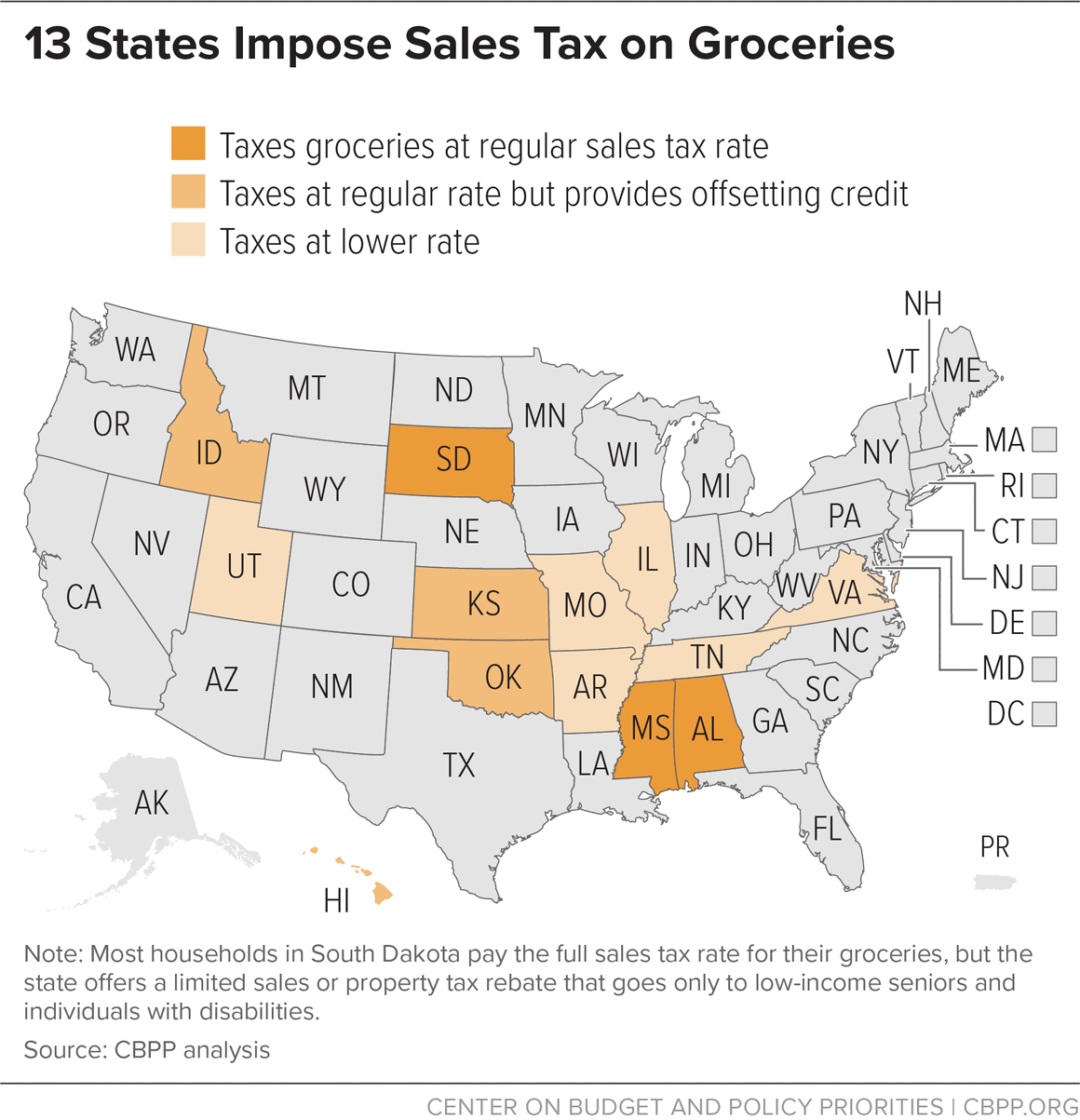

Food in Tennesse is taxed at 5000 plus any local.

. Memphis is located within. Food food ingredients and prepared food are all exempt from sales tax through Aug. Memphis TN Sales Tax Rate.

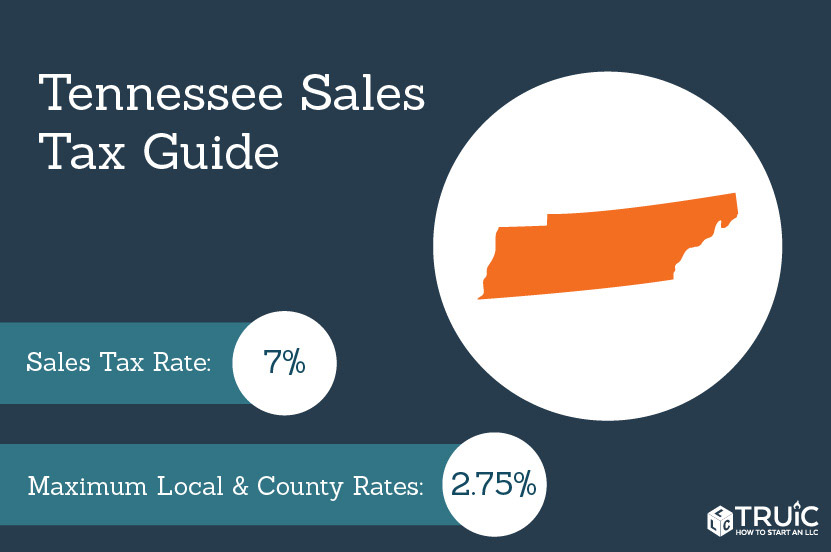

Ive saved probably about 45 in taxes said Chuck Marion. Tennessee has a 7 statewide sales tax rate but also has 307 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2614. The Tennessee sales tax rate is currently.

According to the Tennessee Department of Revenue the sales tax rate on food is 4. The state sales tax rate in Tennessee is 7000. Tax exemption on any.

Memphis collects the maximum legal local sales tax. Food sold in a heated state or heated by the seller. The 975 sales tax rate in Memphis consists of 7 Tennessee state sales tax 225 Shelby County sales tax and 05 Memphis.

The effective date of the tax rate. That means groceries restaurants caterers and food trucks. Prepared meals are fully taxable at the state sales tax rate of 7 plus local tax.

On October 3 2019 voters in the City of Memphis voted to increase the local sales tax rate to 275. Keep in mind. The minimum combined 2022 sales tax rate for Memphis Tennessee is.

The current total local sales tax rate in Memphis TN is 9750. Qualifying headquarters receive a non-expiring sales tax credit for 65 for qualified personal property directly related to the new full-time job creation. This is the total of state county and city sales tax rates.

Prepared food in Tennessee is defined as. Exact tax amount may vary for different items. The average cumulative sales tax rate in Memphis Tennessee is 974.

The December 2020 total local sales tax rate was also 9750. Thursday November 14 2019 0947am. This includes the rates on the state county city and special levels.

The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. 1 Tennessees Sales Tax Holiday on food saved Memphians nearly 7 on their groceries or. With local taxes the total sales tax rate is between 8500 and 9750.

2022 Tennessee state sales tax. These foods are packaged or in their original form and not prepared or served as a.

Tennessee Sales Tax Small Business Guide Truic

Tax Breaks Total 280 Million Amid Sky Rocketing Revenues Tennessee Lookout

Tennessee Grocery Tax Cut For 30 Days Localmemphis Com

/cloudfront-us-east-1.images.arcpublishing.com/gray/CEQDJLEQ3JAMTLOT4DUDSOID3A.jpg)

Three Sales Tax Holidays Coming Soon In Tennessee

Waffle House Menu Dinner Place Mat Used Ebay

Garlic Butter Crablegs Picture Of Regina S Cajun Kitchen Memphis Tripadvisor

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Back To School Sales Tax Holiday Set For July 29 31 Local News Williamsonherald Com

3 Sales Tax Holidays In Tennessee Wreg Com

Groceries Are Tax Free In Tennessee During The Month Of August Localmemphis Com

Solved 6 Gary Runs A Food Truck That Sets Up In Bristol Chegg Com

Memphis Tennessee 1940s Postcard The Skyway Bar Supper Club Hotel Peabody Ebay

Dine On Campus At University Of Memphis Meal Plan Options

Tennessee Sales Tax Holiday On Food Ending Tonight Fox13 News Memphis

Tn Has Its First Ever Tax Free Week On Food Localmemphis Com

Tennessee Tax Free Holiday Expanded In 2021 To Include Prepared Food Food And Food Ingredients